It was inevitable that a media company would get involved on the operator side the nascent US sports betting industry. It was always a matter of “when,” not “if.”

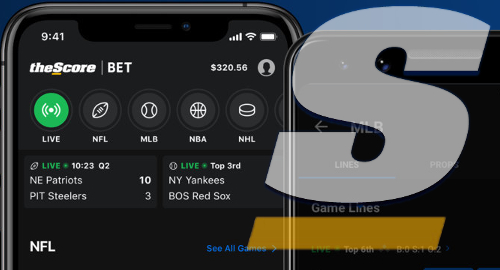

Now we know the “whom.” Sports media company, theScore Inc., announced today that it would launch a New Jersey sports betting app sometime next year.

‘theScore’ media app was launched in 2007 as the company's first venture into the mobile app industry. It has since become one of the most popular multi-sport news apps in North America with approximately.

“This is a transformational moment for theScore, becoming the first media company in North America to announce its plans to launch online and mobile sports betting in the United States,” said John Levy, founder and CEO of theScore.

“Sports betting has long been part of our company DNA in how we’ve delivered content to fans. Providing the ability to actually bet on games is the natural next phase for theScore.”

- Another mobile sportsbook has come to New Jersey.Canadian sports media operator theScore has launched a US sports betting app in the Garden State. The second theScore sportsbook is expected to launch a sports betting app.

- The app is a two-in-one app that allows you to go back and forth between The Score and theScore Bet. Design Users can find theScore Bet app in the App Store for IOS devices, and on theScore Bet website for Android devices, since the Google Play Store does not allow gaming apps on the platform.

- TheScore online sportsbook has come to New Jersey. Canadian sports media operator theScore has launched its US online sports betting app.

- Once you've created your account, login to theScore Bet app and select what bets you'd like to place from the offerings available in your preferred markets. Once you tap your selection it will.

More on theScore and NJ sports betting

TheScore is a publicly traded media company that offers sports scores and news through its app and websites. The plan to get into sports betting for a media company on the operator side makes a lot of sense considering the reach of content and magnitude of theScore.

TheScore is getting into NJ sports betting thanks to a couple of partnerships:

- Its land-based sports betting partner, Monmouth Park Racetrack, has terms set forth of up to 15 years, consisting of an initial term of five years, which is extendable for two successive five-year terms at the option of theScore.

- TheScore is working with startup Bet.Works to provide a sports betting platform and managed services. That deal was termed as an “exclusive nationwide multiyear agreement.”

The Score Betting App Promo Code

The sports betting app must be approved by the NJ Division of Gaming Enforcement. TheScore anticipates a launch in mid-2019.

TheScore has been hinting at its sports betting aspirations

While it wasn’t entirely clear how theScore would make its sports betting entry, it’s not a shocking endeavor for the company.

The company announced this summer that it landed iGaming veteran David Wang as a senior advisor. Wang is also the CEO and founder of Bet.Works and has worked on online gaming and sports betting as a senior executive for both US gaming giants MGM Resorts and more recently Wynn Resorts, where he led the launch of both mobile sports betting businesses.

The Score App Betting Odds

That move evidently presaged today’s announcement, as did Levy talking after theScore’s third-quarter financials:

“This quarter also saw the legalization of sports betting in the United States, which presents an exciting opportunity for us. The state-by-state roll-out of this, and the different models being explored within each individual state, means the US sports betting landscape remains a fluid one.

TheScore is uniquely positioned to capitalize on this opportunity thanks to our mobile sports expertise, combined with our large and highly engaged audience.”

And while the entry point is in NJ, the company has designs on getting into other states. Those plans remain unknown, but rumors point to more states to follow in short order, says one industry insider with knowledge of the roll out into the US.

The potential sports betting reach of theScore

TheScore boasts more than 4 million active users for its sports app, and a database larger than that that could be activated for sports betting purposes, once states start going live.

Other interesting stats about theScore:

- Reached 50 million sports fans on their social and emerging platforms in the third quarter.

- Sent out 1.5 billion sports-related alerts out to users each month. (TheScore even includes whether a team is currently covering the spread in its scoring updates.)

- Has 1 million Instagram follows and 3.4 million Facebook followers.

DraftKings Sportsbook and FanDuel Sportsbook have done well in the early days of the NJ sports betting part because of their existing databases of users and their brand recognition. The two companies combined for two-thirds of all sports gambling revenue in the state in November.

However, theScore represents a serious challenge to the incumbents due to its loyal, dedicated user base.

Thescore App Store

TheScore users and engagements indeed surpass those of the two daily-fantasy-sports-turned-sports-betting operators. The hope is that it can quickly do well in the NJ market and others, if and when they enter new states.

Beyond NJ, online sports betting is only legal in Nevada, Pennsylvania and West Virginia. Online betting launches are still pending in the latter two states.

More on Bet.Works

If you haven’t heard of Bet.Works before now, you’re probably not alone as it’s not yet active as a platform, and its website is just a landing page.

“Bet.Works has secured some of the most prominent executives in the sports betting industry with a blue-chip investor group,” a source familiar with the company and the deal told Legal Sports Report. “Various investors have tried to jump in, but the company is extremely selective and oversubscribed.”

The leading sportsbook suppliers have courted theScore in the industry and it chose Bet.Works based on the performance demonstrated by the enterprise product and US-based management team, the source said.